Need a mortgage? - Contact Cleere Life

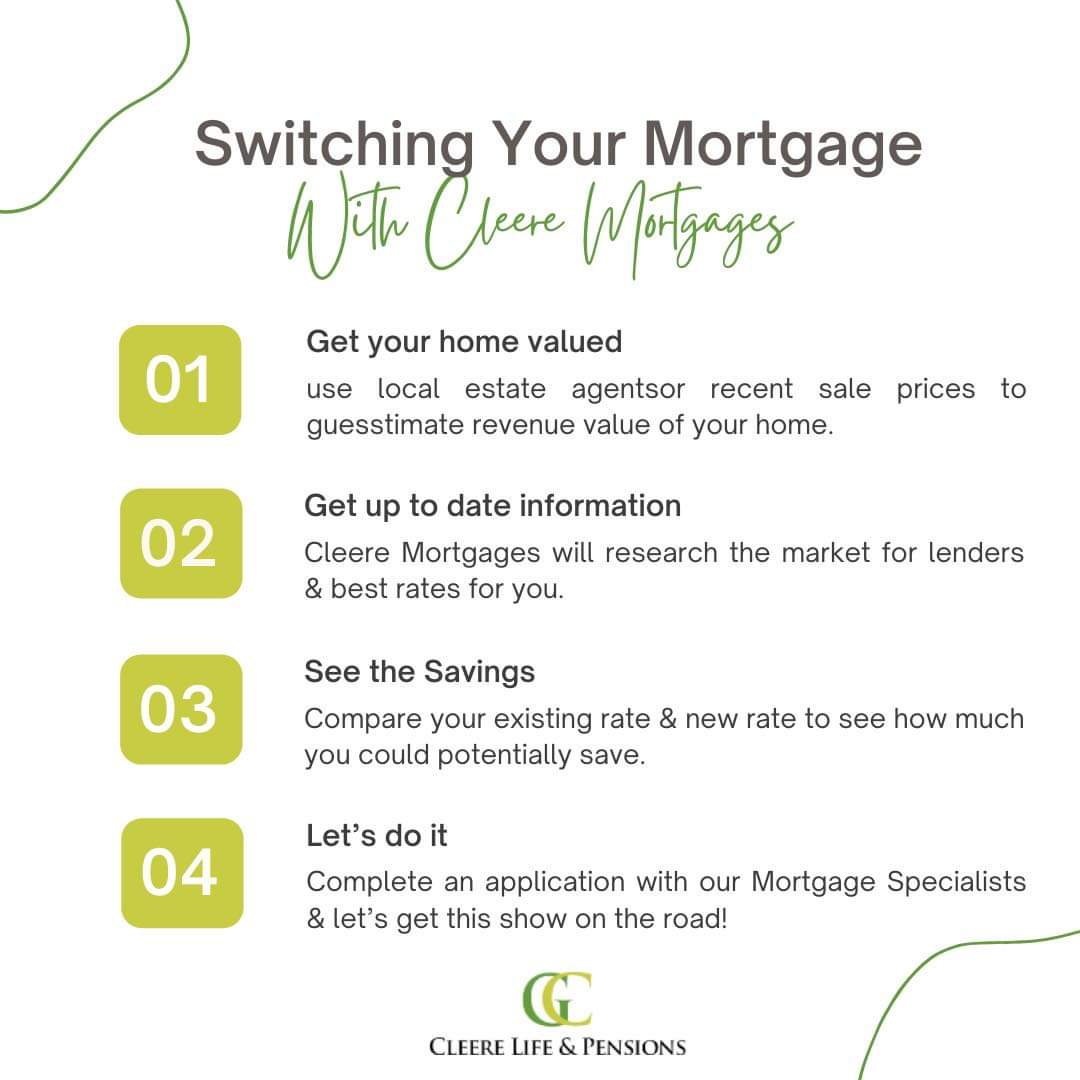

Our experienced mortgage advisors are experts in all types of mortgages ranging from First Time Buyers, to Trading Up to Investment Mortgages. We research the market for you as we have access to all the leading lenders, this ensures you get the right mortgage for your financial circumstances.

We do the work on your behalf, from preparing your documents to signing final contracts. Our aim is to make it as stress free as possible.

How can we help?

Questions:

What will the Mortgage Broker take into consideration as part of your application?

Your savings

It is useful to set up a regular savings account to save your deposit. This has the added benefit of showing your ability to save money each month.

Your day-to-day finances

Make sure you manage your accounts so that you don’t go over your credit limit – banks like to see that you have been managing your finances effectively for a period of time before you apply for your mortgage.

Your other borrowings

It’s a good idea to pay down credit cards and personal loans, if you have any, as much as possible, as additional borrowing could affect the amount you can borrow for your mortgage.

Additional costs

You will need to show how you can cover additional costs such as stamp duty, legal fees and any additional expenses that might be required to make your new property habitable.

Contact Details:

Cleere Life

2 Fairgreen

Naas

Co Kildare

045 936124

Killeen Financial Services Ltd T/A Cleere Life & Cleere Mortgages is regulated by the Central Bank of Ireland

OVERVIEW

At Cleere Life & Pensions our priority is to to provide financial planning solutions for clients in the areas of pensions, protection and investments. The brokerage, a member of BrokerS Ireland, was set up by Gearoid Cleere in January 2015.

Our client base is diverse and includes individuals, sole traders and small to medium companies across Leinster and further afield. Our services are, and always have been, founded on honest, trust and integrity. We offer advice in respect of pensions, Investments, Savings and Life Assurance.

Our client base is diverse and includes individuals, sole traders and small to medium companies across Leinster and further afield. Our services are, and always have been, founded on honest, trust and integrity. We offer advice in respect of pensions, Investments, Savings, Life Assurance & Mortgages. .A Policy Review is a simple process that involves looking at what Life Assurance, Pension and Regular Savings policies a client has. In particular we look at the following; What level of life cover, Specified Illness cover and Income Protection cover you should have based on your circumstances, The current cost of your insurance as well as the term remaining.

This involves doing a price check on your existing policies to make sure you are not paying too much every month. Risk profile and Investment Fund performance check for Pensions and Savings plans. We also look at policy charges and allocation rates of the premiums you are paying (allocation rate refers to the net amount of your premium which is used to purchase units in your policy). High charges in a pension or savings plan can erode a large part of the growth achieved over a long period of time and so it is essential to make sure you are not over paying.

*SPONSORED CONTENT

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.